Navigating the world of car insurance can feel like driving through a dense fog. Premiums vary wildly, and understanding the factors influencing your rate can seem daunting. This comprehensive guide will demystify car insurance rates in 2025, exploring the key determinants and offering practical strategies to lower your costs. We’ll delve into the intricacies of various coverage types, risk assessment methodologies, and the steps you can take to secure more affordable premiums.

Understanding Car Insurance Rates: Key Factors in 2025

Several interconnected factors influence your car insurance premium. Insurers use sophisticated algorithms to assess risk, and understanding these factors empowers you to make informed decisions and potentially save money.

1. Your Driving Record

The Foundation of Risk Assessment

Your driving history is paramount. Accidents, traffic violations (speeding tickets, reckless driving), and even the number of years you’ve been driving license-free influence your risk profile. A clean driving record translates to lower premiums. Multiple accidents or serious violations will significantly increase your rates. Insurers often use a points system, where each violation adds points, leading to higher premiums.

Consider defensive driving courses to potentially reduce points and demonstrate a commitment to safe driving.

2. Your Vehicle

Make, Model, and Safety Features

The type of car you drive is a significant factor. Sports cars and high-performance vehicles are generally more expensive to insure due to their higher repair costs and increased risk of theft. Conversely, smaller, fuel-efficient vehicles often attract lower premiums. Safety features, such as anti-lock brakes (ABS), airbags, and electronic stability control (ESC), can positively impact your rate.

Insurers recognize that vehicles with advanced safety features are less likely to be involved in accidents or result in severe injuries.

3. Your Location

Geographic Risk Assessment

Where you live matters. Areas with high crime rates, frequent accidents, or severe weather events typically have higher insurance rates. Urban areas often command higher premiums than rural areas due to increased traffic congestion and the higher probability of theft or accidents. Insurers analyze claims data from specific zip codes to assess risk and adjust premiums accordingly.

4. Your Age and Driving Experience

A Maturation of Risk

Younger drivers, particularly those with limited driving experience, are statistically more likely to be involved in accidents. This translates to higher premiums. As you gain experience and age, your premiums typically decrease. Insurers consider age as a significant indicator of driving maturity and risk assessment.

5. Your Credit Score

A Surprising Influence

In many states, your credit score can influence your car insurance rates. Insurers often view a poor credit score as an indicator of higher risk. While the exact correlation isn’t always clear, maintaining a good credit score can potentially lead to lower premiums. This practice is controversial and varies by state.

6. Your Coverage Choices

Balancing Protection and Cost

The type and amount of coverage you choose directly impact your premiums. Comprehensive coverage, which protects against damage from events like theft or hail, is more expensive than liability-only coverage. Higher liability limits increase your premium but offer greater financial protection in case of an accident. Carefully evaluate your needs and choose coverage that balances protection and affordability.

Consider factors like your vehicle’s value and your financial situation when making your selection.

Lowering Your Car Insurance Rates: Practical Strategies

Now that you understand the key factors, let’s explore practical strategies to lower your car insurance premiums.

1. Maintain a Clean Driving Record

This is arguably the most effective way to lower your rates. Avoid speeding tickets, practice defensive driving, and always obey traffic laws. A clean record signals low risk to insurers.

2. Choose a Safer Vehicle

If you’re planning to buy a new car, consider vehicles with high safety ratings and advanced safety features. These features can significantly reduce your insurance premiums.

3. Improve Your Credit Score

If your credit score impacts your insurance rates (check your state’s regulations), work on improving it. Pay your bills on time, manage your debt, and monitor your credit report regularly.

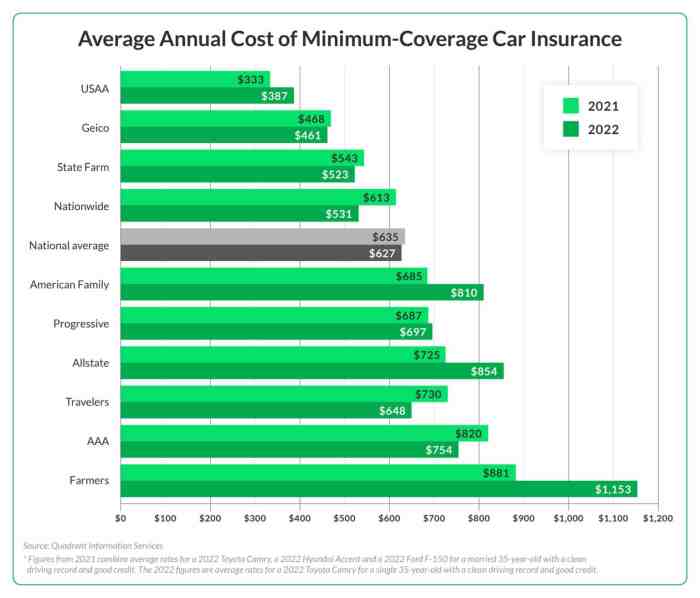

4. Shop Around and Compare Quotes

Don’t settle for the first quote you receive. Compare quotes from multiple insurers to find the best rates. Online comparison tools can simplify this process.

5. Bundle Your Insurance

Many insurers offer discounts for bundling car insurance with other types of insurance, such as homeowners or renters insurance. This can result in significant savings.

6. Increase Your Deductible

A higher deductible means you pay more out-of-pocket in case of an accident, but it can lower your premiums. Weigh the risk and potential savings carefully.

7. Take a Defensive Driving Course

Completing a defensive driving course can demonstrate your commitment to safe driving and potentially earn you a discount.

8. Maintain a Good Payment History

Paying your premiums on time consistently demonstrates financial responsibility and can positively impact your rates with some insurers.

9. Consider Usage-Based Insurance (UBI)

Some insurers offer UBI programs that track your driving habits. If you’re a safe driver, you might qualify for lower premiums.

10. Ask About Discounts

Inquire about available discounts, such as those for good students, military personnel, or members of certain organizations.

Frequently Asked Questions (FAQ)

- Q: How often do car insurance rates change? A: Rates can change periodically, often annually, due to factors like inflation, claims frequency, and changes in risk assessment models.

- Q: Can I get car insurance without a driving record? A: Yes, but it’s likely to be more expensive. Insurers may use other factors to assess risk, such as age and location.

- Q: What is the difference between liability and comprehensive coverage? A: Liability coverage protects you financially if you cause an accident, while comprehensive coverage protects your vehicle from damage due to events like theft or hail.

- Q: How does my credit score affect my car insurance rate? A: In many states, a lower credit score can lead to higher insurance premiums, although this practice is controversial and varies by state.

- Q: What is usage-based insurance (UBI)? A: UBI programs use telematics devices or smartphone apps to track your driving habits, potentially offering lower rates for safe driving.

References

Get Your Personalized Quote Today!

Ready to find the best car insurance rates for your needs? Contact us for a free, no-obligation quote. Let us help you secure the coverage you need at a price you can afford.

Source: cloudfront.net

Detailed FAQs

What factors besides driving history affect my car insurance rates?

Your location, age, credit score, the type of car you drive, and the coverage you choose all significantly impact your rates.

Can I lower my rates by bundling insurance policies?

Yes, many insurers offer discounts for bundling car insurance with other policies, such as homeowners or renters insurance.

How often should I shop around for car insurance?

It’s advisable to compare rates annually, or even more frequently if your circumstances change (e.g., new car, move, change in driving record).

What is a usage-based insurance program?

Source: wcnc.com

These programs use telematics devices or smartphone apps to track your driving habits. Safe driving can lead to lower premiums.

Are there discounts for safety features in my car?

Yes, many insurers offer discounts for vehicles equipped with anti-theft devices, airbags, and other safety features.